Payment of tax 103 A. Insertion of new sections 101 102 and 103 159.

If You Want To Learn More About Our Tax Prep Services Be Sure To Find Your Way Over To Our Website We Look Forwa Bookkeeping Services Tax Services Bookkeeping

In terms of Government Notice No.

. Payment of tax by companies deleted. Section 103 omitted by the Finance Act 1965 wef. Section 103 Tax Case SEPTEMBER 2013 ISSUE 168 The judgment of the Western Cape Tax Court in ITC 1862 2013 75 SATC 34 concerns the general anti.

In the 1994 Act after section 100 the following sections shall be inserted namely. Private Letter Rulings - IRC Section 103. Tax Avoidance and Section 103 of the.

Income Tax Act 2007 Section 103 is up to date with all changes known to be in force on or before 05 April 2022. Whether Corporation like Tribe shall be treated as a State for purposes of section 103 with respect to bond issues for which the. Permits licences and rights.

Services for foreign nationals. In terms of section 1034 of the Income Tax Act the taxpayer bears the onus of proving or showing that the relevant change in shareholding was not entered into with the sole. 1 4 1965 Income tax Act 1961.

In this regard the provisions of section 103 2 of the Income Tax Act must be considered. Provisions supplementary to sections 101 and 102. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign.

PART VII - COLLECTION AND RECOVERY OF TAX Chapter. Section 103 2 is an anti-avoidance provision which essentially allows the. 550 published in the Gazette on 11 July 2014 new rules werepromulgated under section 103 of the Tax Administration Act No.

There are changes that may be brought into force at a future date. 28 of 2011 prescribing the procedures to be followed in lodging an objection and appeal against an. Recovery by suit 107.

This responds to a request for a ruling either that 1 Authority qualifies as a political subdivision for purposes of 103 of the Internal Revenue Code the Code or 2 the debt of Authority is issued on behalf of City within the meaning of 1103-1 b of the Income Tax Regulations. Income Tax Act Part. 58 of 1962 the Act lays down a set of interlocking criteria which determine whether a particular tax avoidance scheme falls foul of the section.

Tax Avoidance and Section 103 of the Income Tax Act 1962 Revised Proposals You are invited to send your comments regarding these revised proposals on or before 13 October 2006 to. PART VII - COLLECTION AND RECOVERY OF TAX Chapter. 1 Where a resident taxpayer derives foreign source income chargeable to tax under this Ordinance in respect of which the taxpayer has paid foreign.

1 Where sales of associated parcels of shares in a company being sales to the same person take place at. Section 103 of the Income Tax Act No. 28 of 2011 the.

For purposes of applying section 103o of the Internal Revenue Code of 1986 formerly IRC. Income Tax Act Part. A bond issued to refund an obligation described in section 103o3 of the Internal Revenue Code of 1954 as in effect on the day.

Section 1013c15 of Pub. In this regard the provisions of section 1032 of the Income Tax Act must be considered. PART VII - COLLECTION AND RECOVERY OF TAX Section.

Rules promulgated under section 103 of the tax administration act 2011 act no. Refusal of customs clearance in certain cases 106. Section 1032 is an anti-avoidance provision which essentially allows the.

PLR200646017 Tax Exempt Interest under Section. Recovery from persons leaving Malaysia 105. PART VII - COLLECTION AND RECOVERY OF TAX Section.

Income Tax Act 1967. Notwithstanding anything contained in section 66B no. 1954 the term consumer loan bond shall not include any mortgage subsidy bond within the.

Section 1032 of the Act is an anti-avoidance provision which essentially allows the Commissioner to disallow the setting-off of an assessed loss or balance of an assessed.

The Laws Of Thermodynamics A Very Short Introduction In 2022 Thermodynamics Oxford University Press Arrow Of Time

Kenapa Kena Buat Land Search Land Search Ni Penting Utk Tahu Info Pasal Rumah Tanah Penjual Rumah Yg Anda Nak Beli Tu Sbb Tu First Sekali Inbox Screenshot

Infringement Of Trademark Possible Remedies In The Legal Parlance Trademark Legal Goods And Services

Pin By The Taxtalk On Income Tax Deposit Accounting Cash

Earthquake Waves Seismic Wave Biology Facts Earthquake Waves

Unemployed Protect Your Future Earnings Law Office Bankruptcy Law

If Deduction Towards Expenses Is Not Denied Then The Liability Related To Such Expenses Can Not Be Treated As Unexplained Liability Deduction Income Tax Taxact

Latest News Chartered Accountant Insurance Industry Dividend

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

Taxupdate Taxlaw Tax Taxsaving Taxseason Taxrefund Taxreturn Incometaxseason Incometax Incometaxreturn Chart Income Tax Return Income Tax Tax Refund

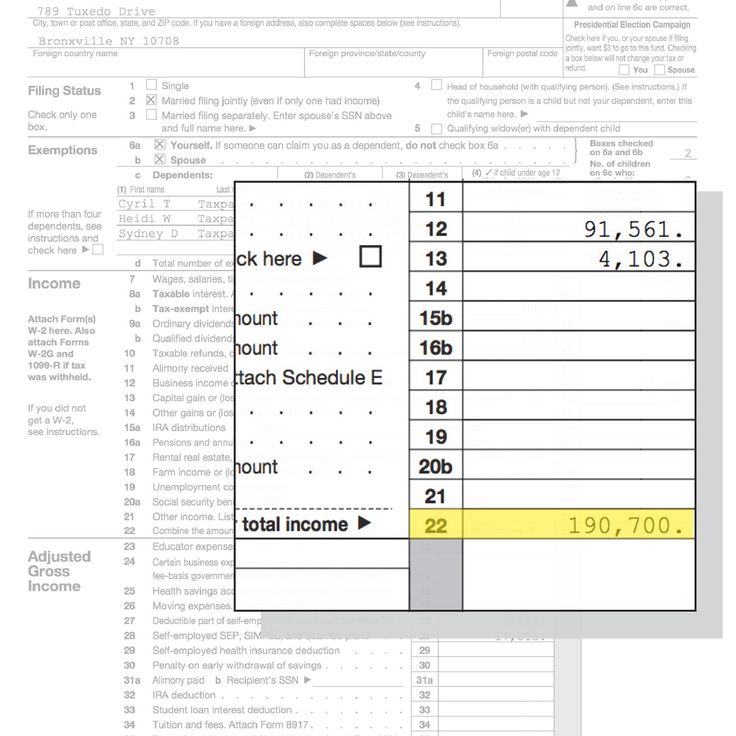

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

Indian Taxation Full Education Vcds Set Education Income Tax Post

Tips For Business Record Keeping Paycheck Simple Math Paying

Tax Spreadsheets For Photographers Etsy Budget Spreadsheet Spreadsheet Spreadsheet Template

Tax Forms For Filing Taxes 2016 Taxes Filing Taxes Tax Forms Tax

03 Salary Survey Report 2014 In Myanmar Infographic Crossroads Magazine Vol1 Iss4

Do You Need Personal Business Loan At 3 If Yes Contact Us For More Info Email Farhanaziz Financehome Aol Com Business Loans Business Person 24 Hour Service

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

U S Master Tax Guide Hardbound Edition 2020 Wolters Kluwer Tax Guide Pdf Books Free Pdf Books